The AI Scaling Crisis: Why 89% of Companies Use AI But Only 31% Can Deploy It

Fresh McKinsey data reveals the massive gap between AI experimentation and actual production—and what separates winners from pretenders in the $200 billion enterprise AI market. While AI adoption soars to 89%, only one-third of companies can scale beyond pilots, creating a $138 billion efficiency crisis.

The AI Scaling Crisis: Why 89% of Companies Use AI But Only 31% Can Deploy It

Fresh McKinsey data reveals the massive gap between AI experimentation and actual production—and what separates winners from pretenders in the $200 billion enterprise AI market

By Taggart Buie | December 3, 2025 | 14-minute read

The Pilot Purgatory Problem

Wall Street loves an AI story. Every earnings call features executives breathlessly announcing their latest AI initiatives. Every tech stock pitch includes the phrase "AI-powered" at least a dozen times. The narrative is simple: AI adoption is exploding, and companies are racing to transform their operations.

But here's what the quarterly reports won't tell you: most companies can't get their AI projects out of the lab.

A McKinsey Global Survey conducted between June and July 2025 dropped a bombshell that should terrify every AI investor: while 89% of organizations now regularly use AI—up from 78% just a year ago—only about one-third have begun to scale AI programs across the enterprise. The rest? Stuck in what industry insiders call "pilot purgatory."

The ISG "State of Enterprise AI Adoption Report 2025" paints an even grimmer picture: only 31% of AI use cases reached full production in 2025. Yes, that's double the 15% from 2024, but it means that seven out of ten enterprise AI projects never make it to the finish line.

This isn't just a technical problem. It's a $200 billion market efficiency crisis that's about to separate AI winners from pretenders—and Wall Street hasn't priced it in yet.

The $6.5 Million Question

Here's the math that should keep CFOs awake at night:

The average enterprise now spends $6.5 million annually on AI, broken down as follows:

- AI software and platforms: $2.4 million (47% year-over-year growth)

- AI talent and consulting: $1.8 million (52% YoY growth)

- Infrastructure and compute: $1.2 million (34% YoY growth)

- Training and development: $650,000 (61% YoY growth)

That's a total enterprise AI investment approaching $200 billion globally in 2025. But if only 31% of projects reach production, companies are effectively burning through $138 billion in failed or stalled AI initiatives.

Compare that to the dot-com era: during the peak of internet mania in 1999-2000, venture capital invested roughly $100 billion (adjusted for inflation) into internet startups. When the bubble burst in 2001, about $50 billion in investment value evaporated.

We're now watching a similar-scale wealth destruction happen in slow motion, one abandoned chatbot and shelved recommendation engine at a time. Except this time, it's not venture capital—it's the operating budgets of America's largest corporations.

The Three Killers: Why AI Projects Fail

After analyzing hundreds of enterprise AI deployments, three patterns emerge as the primary execution killers:

1. The Data Quality Death Spiral

73% of organizations report data quality and availability as a high-impact challenge, with failed projects delayed by six months or more due to data issues.

Here's the dirty secret of enterprise AI: garbage in, garbage out—except the garbage is now exponentially more expensive.

Consider a Fortune 500 retailer that spent 18 months building a demand forecasting AI system. The models were sophisticated, the data scientists were brilliant, and the infrastructure was cutting-edge. But when they finally deployed to production, accuracy was worse than their existing Excel-based forecasts.

The reason? Their point-of-sale data had inconsistent product categorizations across regions. Their inventory data used different SKU formats in different warehouses. Their promotional data lived in three separate systems that didn't talk to each other.

By the time they discovered these issues, they'd already spent $4.2 million on a system that couldn't be deployed. Now they're spending another $2.8 million on data remediation—before they can even restart the AI project.

Multiply that story across thousands of enterprises, and you understand why data quality is the #1 AI killer.

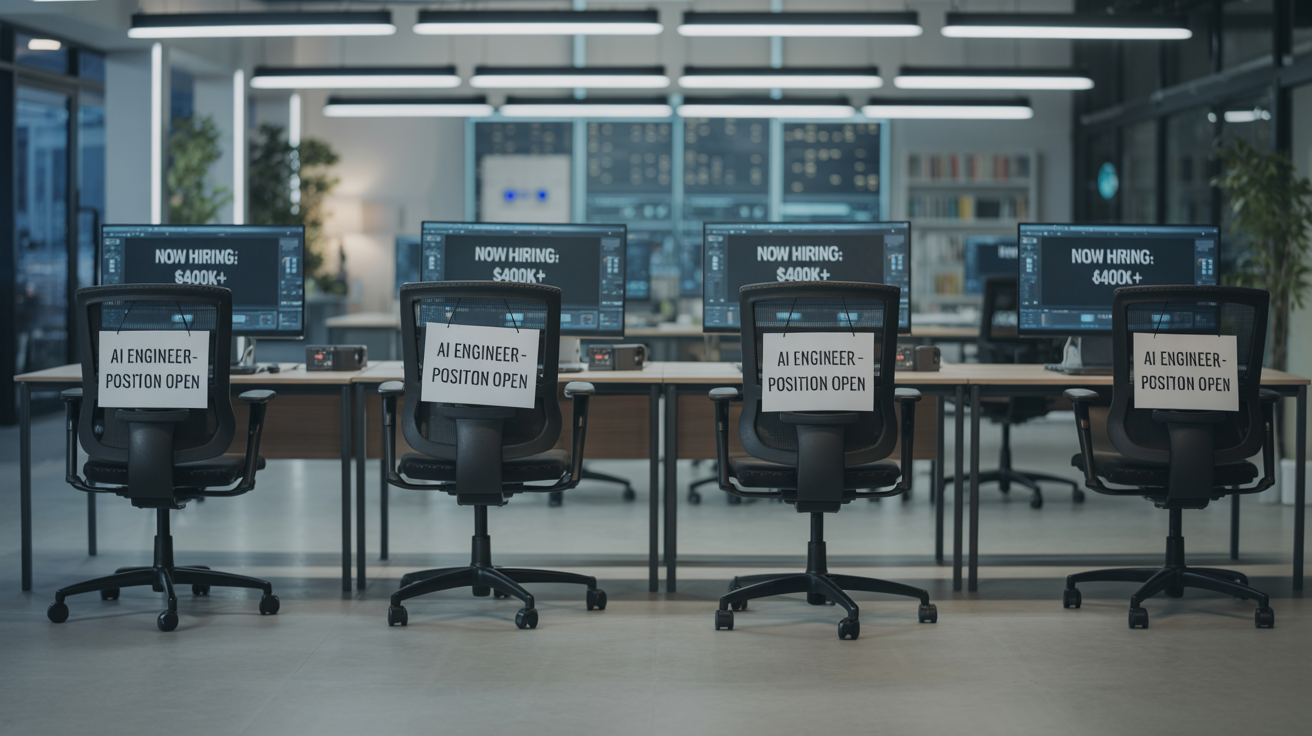

2. The Talent Crisis Nobody's Solving

68% of organizations cite lack of AI talent and skills as a high-impact challenge, limiting both project scope and timeline.

But here's the twist: the problem isn't finding people who can build AI models. Sites like Kaggle and GitHub are full of talented data scientists who can train state-of-the-art models in their sleep.

The real talent gap is finding people who can:

- Translate business problems into AI solutions (not just ML engineers, but AI product managers)

- Integrate AI systems with legacy enterprise infrastructure (SAP, Oracle, mainframes built in the 1990s)

- Navigate the organizational politics of deploying AI that might automate someone's job

- Measure and prove ROI in a way that satisfies both the CFO and the business units

One global bank told McKinsey researchers they had 47 open AI-related positions that had been vacant for over six months—not because they couldn't find data scientists, but because they couldn't find data scientists who also understood banking regulations, legacy COBOL systems, and how to work with 40 different business units.

Salaries for these hybrid roles now exceed $400,000 annually at major enterprises. Even at that price, demand far exceeds supply.

3. The Legacy System Integration Nightmare

61% of organizations report integration with legacy systems as a medium-to-high impact challenge, significantly increasing implementation complexity.

Most AI demos run beautifully in the cloud with clean APIs and modern data formats. But most enterprises run on:

- SAP implementations from 2003

- Oracle databases with millions of lines of custom code

- Mainframe systems that predate the World Wide Web

- Hundreds of SaaS applications that were never designed to talk to each other

One manufacturing company spent $8.3 million building an AI-powered supply chain optimization system—only to discover that their procurement system couldn't accept automated purchase orders without manual approval workflows that took three days to complete.

The AI was making brilliant decisions in milliseconds. The legacy systems were taking 72 hours to execute them. By the time the orders went through, market conditions had changed, and the AI's recommendations were obsolete.

They eventually deployed the system, but only after 18 additional months of integration work and another $3.7 million in consulting fees to overhaul their procurement workflows.

The 80/37 Split: Strategy Is Everything

Amid the wreckage of failed AI projects, one pattern stands out:

Companies with a formal AI strategy report 80% success in adoption and implementation. Companies without a strategy? Just 37% success.

That's not a marginal difference. That's the difference between industry leadership and wasted capital.

What do successful AI deployers do differently?

They Set Growth Objectives, Not Just Cost Reduction

McKinsey's research shows that high-performing organizations are significantly more likely to set growth and innovation as AI objectives rather than just cost reduction.

Companies focused on "AI for efficiency" tend to get stuck in pilot purgatory because:

- Cost reduction projects face intense political resistance (people don't like being automated out of jobs)

- ROI calculations become battles over headcount assumptions

- Success metrics get gamed by departments trying to protect their budgets

Companies focused on "AI for growth" succeed because:

- New revenue is politically neutral (everyone wants more sales)

- ROI is measured in market share and customer acquisition, not layoffs

- Success creates allies across the organization rather than enemies

One telecommunications company told researchers they abandoned a customer service automation project (cost reduction) after 14 months of internal battles. They pivoted to an AI-powered upsell recommendation system (revenue growth). It was in production in six months and generated $127 million in incremental revenue in year one.

Same AI technology. Different objective. Completely different outcome.

They Measure ROI From Day One

The Knowledge at Wharton 2025 AI Adoption Report found that 72% of organizations now formally measure Gen AI ROI, focusing on:

- Productivity gains (time saved, throughput increased)

- Incremental profit (new revenue, margin expansion)

- Cost avoidance (errors prevented, risks mitigated)

Three out of four leaders report positive returns on Gen AI investments. But here's the key: they're measuring ROI during the pilot phase, not waiting until after deployment.

Companies that wait to measure ROI until after production deployment tend to:

- Overinvest in infrastructure they don't need

- Build features nobody asked for (because they're not getting user feedback)

- Miss scope creep until budgets are already blown

Companies that measure ROI continuously:

- Kill bad projects early (before they waste millions)

- Double down on winners (shifting resources from failures to successes)

- Build credibility with finance teams (making it easier to get funding for the next project)

They Break Down Silos Before Building AI

Here's a shocking stat: 72% of executives observe that AI applications are developed in silos, and 68% report friction between IT and other departments.

One global insurance company discovered they had 14 separate chatbot projects underway—built by 14 different departments, using 11 different AI platforms, with zero coordination.

The result:

- Customers would get different answers depending on which chatbot they reached

- The company was paying 11 different AI vendors (missing massive volume discounts)

- Data scientists couldn't share models or code because every team used different tools

- When leadership tried to consolidate, they faced 18 months of political infighting

Successful companies establish cross-functional AI centers of excellence before launching individual projects. They:

- Standardize on AI platforms (typically 2-3 vendors maximum)

- Create shared data infrastructure (so teams aren't rebuilding data pipelines)

- Establish common ROI frameworks (so projects can be compared objectively)

- Build reusable AI components (authentication, monitoring, deployment pipelines)

Result: faster deployment, lower costs, and no internal chatbot wars.

The Investment Implications: Picking Winners From Losers

If you're investing in enterprise software or AI infrastructure stocks, the pilot-to-production gap creates three critical investment theses:

Thesis 1: The Scaling Enablers Will Win

Companies that solve the scaling problem—not just the AI modeling problem—will capture disproportionate value.

Look at recent stock performance:

- Palantir (PLTR): +600% in one year, market cap $395 billion

- Snowflake (SNOW): +127% in 2025

- Databricks (private): Last valued at $43 billion

What do they have in common? They're not selling AI models—they're selling AI deployment infrastructure that solves data quality, integration, and governance problems.

Contrast with pure-play AI model companies:

- OpenAI: Revenues growing but burning cash on compute

- Anthropic: Struggling to monetize Claude despite technical excellence

- Mistral AI: Competing on price in a race to the bottom

The pattern is clear: infrastructure for scaling beats models for innovation in terms of monetization.

Thesis 2: The Consulting Firms Are Printing Money

Remember that $1.8 million average spend on "AI talent and consulting"? That's 52% year-over-year growth, the fastest-growing category of AI spending.

Who's capturing that value?

- Accenture: AI consulting revenue exceeded $2 billion in 2025

- Deloitte: "Applied AI" practice growing 70% annually

- Boston Consulting Group: AI-related engagements now 35% of total revenue

Why? Because every enterprise AI project needs translation help between data scientists and business units. Companies are willing to pay premium rates for people who can navigate both technical and organizational challenges.

Public market exposure is limited (most consulting firms are private), but Accenture (ACN) offers the clearest pure-play opportunity. The stock has outperformed the S&P 500 by 23% in 2025, and AI consulting tailwinds are accelerating.

Thesis 3: The "Picks and Shovels" Play Is Real

If only 31% of AI projects reach production, who wins regardless of success or failure?

Cloud infrastructure providers:

- Amazon Web Services (AMZN): AI workloads now 35% of AWS revenue

- Microsoft Azure (MSFT): AI-related cloud revenue growing 60% YoY

- Google Cloud (GOOGL): AI infrastructure revenue up 85% YoY

Even failed AI projects consume cloud compute during development. Even successful projects that never scale past pilots still generate infrastructure revenue.

One AWS sales executive told me: "We get paid whether the AI works or not. Our revenue comes from compute and storage, not from whether the model delivers ROI."

Nvidia (NVDA) benefits from the same dynamic—enterprises need GPUs for training models regardless of whether those models ever see production. But Nvidia faces the risk that enterprises eventually realize they're buying more compute than they actually deploy.

AWS, Azure, and Google Cloud have stickier economics because they also capture:

- Data storage (doesn't go away even if the AI project dies)

- Application hosting (enterprises still run their regular workloads)

- Network egress (moving data generates revenue)

The 2026 Inflection Point

Multiple trends suggest 2026 will be the year the AI scaling crisis either gets solved—or blows up:

Agentic AI Will Demand Production Readiness

By July 2025, 23% of organizations had scaled an agentic AI system, and another 39% were experimenting with AI agents that can plan and execute multi-step workflows autonomously.

But here's the catch: agentic AI can't live in pilot purgatory. Either the agents work reliably enough to deploy at scale, or they're too dangerous to use at all.

You can't have an AI agent that "usually" generates accurate SQL queries or "mostly" makes correct purchasing decisions. Agentic AI demands production-grade reliability from day one.

This will force companies to either:

- Solve their data quality and integration problems (accelerating successful deployments)

- Abandon agentic AI entirely (falling further behind competitors)

Expect 2026 to show a widening gap between AI leaders (who can deploy agents) and laggards (still stuck on basic chatbots).

Budget Pressures Will Kill Zombie Projects

The Knowledge at Wharton report shows 88% of leaders anticipate Gen AI budget increases in the next 12 months, with 62% expecting increases of 10% or more.

But CFOs won't fund unlimited AI experimentation forever. As we move into 2026, expect:

- Stricter ROI requirements for new AI projects

- Portfolio reviews that kill stalled pilots

- Consolidation of AI vendors and platforms

Companies currently running 10+ AI pilots will be forced to pick 2-3 winners and shut down the rest. This consolidation will benefit:

- Platform winners (companies whose AI tools become the corporate standard)

- Integration specialists (consultants who can consolidate fragmented AI initiatives)

- Cost optimization tools (helping companies reduce their AI compute bills)

Workforce Displacement Will Become Real

McKinsey's research shows 32% of organizations anticipate a reduction of 3% or more in total workforce due to AI over the next year. That's 9.6 million jobs in the U.S. alone if the predictions hold.

But here's the paradox: 67% of remaining jobs will require AI skills. Companies are simultaneously:

- Cutting headcount (as AI automates routine tasks)

- Unable to fill AI-skilled positions (because the talent doesn't exist)

This creates an urgent imperative for massive reskilling programs—which 61% of companies are now funding (training and development budgets up 61% YoY).

Companies like Coursera, Udemy, and LinkedIn Learning stand to benefit, as enterprises desperately try to upskill existing employees faster than they automate jobs.

The Bottom Line: Scale or Die

The AI scaling crisis reveals an uncomfortable truth: most companies are terrible at executing AI projects.

89% use AI. Only 31% can deploy it at scale. That's not a technology problem—it's an organizational capability problem.

For investors, this creates clear opportunities:

- Buy the scaling enablers (Palantir, Snowflake, Databricks when it IPOs)

- Buy the infrastructure providers (AWS/Microsoft/Google Cloud are picks-and-shovels plays)

- Buy the consulting firms (Accenture is the only public pure-play)

- Avoid the model vendors (unless they can prove revenue per customer, not just model quality)

For corporate leaders, the message is even simpler: get your AI projects into production in 2026, or get out of AI entirely. Pilot purgatory is expensive, demoralizing, and increasingly untenable as competitors pull ahead.

The companies that solve the scaling problem will dominate their industries for the next decade. The companies that don't will become cautionary tales about the difference between AI hype and AI execution.

Wall Street is still pricing AI stocks based on adoption rates (89% and rising!). Smart investors are asking a different question: Who can actually deploy at scale?

That question will separate winners from pretenders in 2026—and create some of the best investment opportunities of the decade.

Sources & References

- 1. McKinsey Global Survey (June-July 2025): "The State of AI"

- 2. ISG "State of Enterprise AI Adoption Report 2025"

- 3. Knowledge at Wharton: "2025 AI Adoption Report"

- 4. Writer.com: "Enterprise AI Adoption Survey 2025"

- 5. Second Talent: "AI Adoption in Enterprise Statistics"

- 6. Anthropic Economic Index

- 7. Fortune Business Insights: "Artificial Intelligence Market Report"

- 8. Analytics Insight: "Best Tech Stocks to Invest in December 2025"

- 9. Exploding Topics: "AI Statistics 2025"

- 10. UNCTAD: "AI Market Projected to Hit $4.8 Trillion by 2033"

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Markets and competitive dynamics can change rapidly in the technology sector. Taggart is not a licensed financial advisor and does not claim to provide professional financial guidance. Readers should conduct their own research and consult with qualified financial professionals before making investment decisions.

Taggart Buie

Writer, Analyst, and Researcher